Step-by-step SME Digital Lending: How Are Banks Achieving 24-hour Credit Decisions Without Replacing Systems?

Digitising SME lending is back on the strategic agenda for many banks – and for good reason. Businesses now expect a simple, fully online process and decisions within 24 hours. The pressure isn’t just coming from other banks, but also from agile fintechs. So what’s holding large institutions back? In this article, we share practical insights from working with banks and outline how to scale SME lending step by step, using a proven solution: the Digital Banking Platform (DBP).

What You Need to Know:

- A 24-hour SME credit decision is achievable through end-to-end automation, no need to replace core systems.

- Fragmented, manual workflows remain the biggest bottleneck; streamlining them cuts time and reduces cost.

- The Digital Banking Platform enables a phased rollout with minimal IT involvement and no disruption to operations.

Why Aren’t Banks Scaling SME Lending Despite Growing Demand?

SME lending demand in Poland is growing steadily – some banks are seeing year-on-year increases of 10–20%¹. Entrepreneurs are seeking funds for investments, business expansion and refinancing.

A similar trend is emerging across the Middle East and North Africa, where the development of the SME sector has become a strategic economic priority. In these regions, private financial institutions are increasingly bridging the credit gap.

Yet many banks still struggle to scale their SME lending portfolios to meet market expectations. The challenge isn’t the lack of tools or strategy, it’s the absence of a cohesive, end-to-end digital credit process.

The Main Barriers to SME Lending Automation

In retail banking, real-time credit decisions in minutes have become the norm. So why does SME lending still take days – or even weeks?

The answer lies not in technology, but in the real-world complexities of the SME segment:

Lack of Standardised Data and Scoring

SMEs are an incredibly diverse group – ranging from sole traders to limited companies and seasonal businesses. Financial data comes in various formats (e.g. tax declarations, balance sheets), often incomplete or difficult to benchmark. This makes automated risk assessment difficult without tailored logic and scoring models.

Higher Risk and Regulatory Requirements

SME applications require more than just creditworthiness assessment. Banks must conduct AML checks, verify ultimate beneficial ownership (UBO), assess industry risk and evaluate collateral. Any automation must be auditable, compliant and transparent by design.

Manual, Disconnected Internal Workflows

Even when an application is submitted online, it’s often routed through multiple departments – sales, credit analysts, risk, legal. Documents are exchanged via email, data is copied manually, and each correction adds delays. This inflates costs and slows the overall process.

The key takeaway? It’s not the technology that limits a 24-hour turnaround. Banks looking to scale SME lending must first redesign the process, not just implement a scoring engine.

A Complete SME Lending Journey with the Digital Banking Platform

The Digital Banking Platform (DBP) is a ready-to-use, modular solution enabling banks to digitise the full SME credit lifecycle – from application to disbursement. It’s built on Altkom Software’s extensive experience delivering technology for financial institutions.

Unlike point solutions, DBP connects all core components – channels, product logic, decision workflows and integrations – into a single, cohesive engine. It can be rolled out gradually and tailored to each institution’s needs.

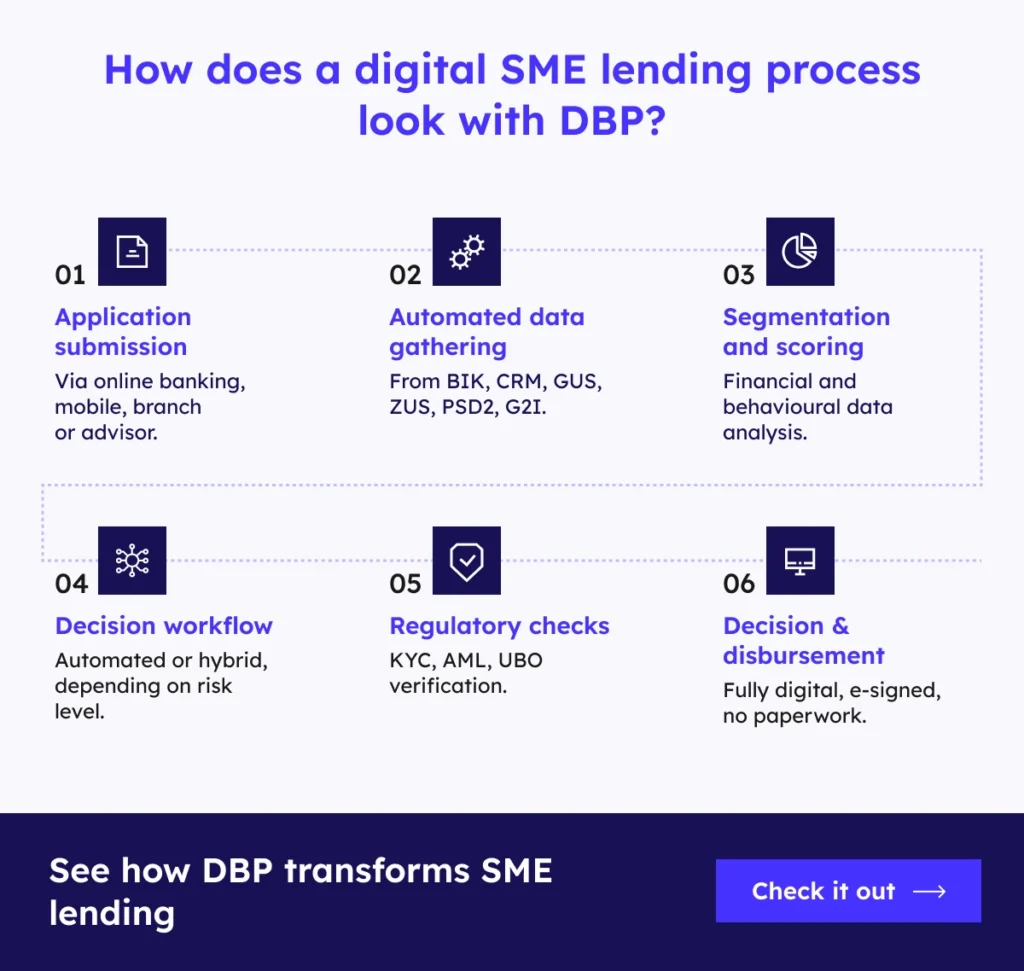

Below is a simplified end-to-end model of the SME lending process, built using our platform.

Omnichannel Support

DBP supports lending across all channels – online banking, mobile apps, branches and third-party advisors. Regardless of the entry point, the customer experiences a seamless, consistent journey.

Outcome: Greater access to lending, improved customer experience and higher conversion.

Segmentation & Personalisation

Built-in classification engines segment clients based on CRM data, credit history or transactional behaviour. DBP tailors offers to fit each customer profile – with the option to enhance segmentation using AI.

Outcome: Better-targeted offers, less manual processing, faster decisions.

Credit Product Management

DBP supports multiple financing types (e.g. working capital, investment loans, guarantees) through a single, configurable process. Product parameters can be adjusted, and new variants launched without IT involvement.

Outcome: Greater product flexibility, faster time-to-market.

Automated & Configurable Workflow

This is the engine room of DBP. It orchestrates the entire lending process – from data collection and scoring to approval and disbursement – based on customisable workflows.

It integrates with internal systems (scoring, BIK, AML) and triggers all required actions without manual input.

The rules and workflow engine enables banks to:

- Define custom application flows

- Set decision rules and exceptions

- Monitor progress and react in real time

Outcome:

- Decisions in as little as 24 hours

- Lower operational costs through automation

- Fast adaptation to regulatory or product changes – no IT backlog

Seamless Integration with Bank Systems

DBP runs within your existing environment – no core system replacement or data migration required. It connects to all critical systems and data sources to enable a fully automated lending process.

Supported integrations include:

- CRM, core banking, card systems

- Risk and scoring engines

- Bancassurance and document workflows

- External data (KRS, ZUS, GUS, BIK, PSD2, G2I)

- AI and decision engines

Outcome: Rapid digitisation of the lending process without disruption to ongoing operations.

SME Lending Platform – Frequently Asked Questions

In every conversation with banks, we hear the same key questions. We’ve gathered them in one place – and answered them based on real-world Digital Banking Platform implementations.

Do we need to implement everything at once?

One of the most common concerns: “Do we need to change our entire system?” The answer is: No.

With DBP, you can:

- Start with a single stage (e.g. scoring, decision, disbursement)

- Integrate only selected systems (e.g. CRM, core, risk)

- Launch an MVP in one channel (e.g. mobile or branch)

- Measure impact without overwhelming IT teams

The modular design lets you start small, validate outcomes and scale at your own pace – with no operational risk.

Why are fintechs outperforming banks?

We often hear: “Fintechs are faster because they have modern systems.”

That’s only half true.

Fintechs excel because they:

- Operate without silos

- Run the entire process on a single platform

- Simplify onboarding and avoid in-person steps

DBP gives banks the same agility, while maintaining control, regulatory compliance and data security.

Have a core system you want to keep? Good. DBP is not a competitor – it’s the bridge that connects and streamlines your existing landscape.

Can a credit decision really be made in 24 hours?

Technically – yes. The application, data analysis and decision can be fully automated and completed within hours. The final turnaround depends on internal procedures, e.g. approval steps, manual risk assessments, formal requirements.

That’s why, beyond technology, we advise on how to simplify and optimise the lending process itself to unlock real business impact.

How do we know if the implementation will deliver ROI?

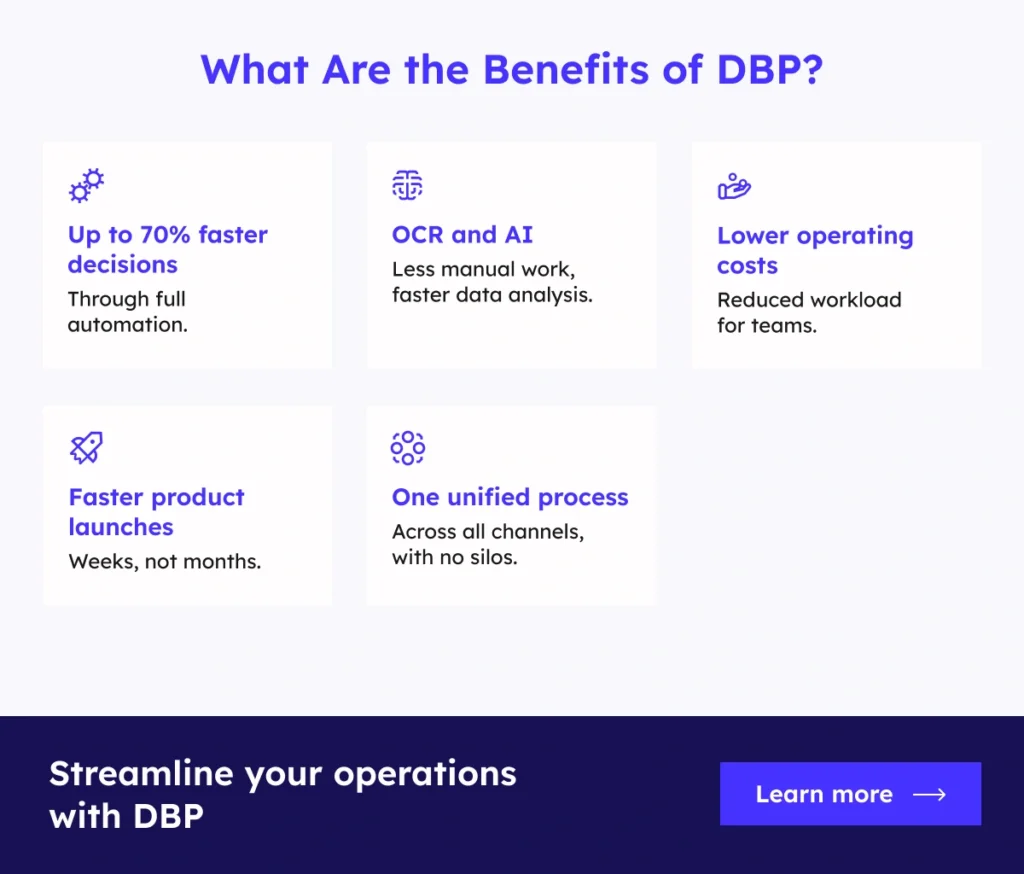

Banks using DBP measure more than just clicks. They track concrete outcomes:

- Faster decisions: time from application to decision drops from 5–10 days to 1–2 days.

- Lower costs: automation reduces application processing cost by up to 70%.

- Scalability: one agent can process significantly more applications.

- Improved customer experience: higher NPS, fewer drop-offs thanks to a fully digital journey.

- Faster go-live: a new credit process MVP can be launched in just 3 months – with no core system replacement.

Who is the Digital Banking Platform for?

For banks that:

- Want to scale SME lending but are constrained by legacy processes or architecture.

- Are looking for true automation, not just a digital front end.

- Need rapid implementation and measurable results – without burdening IT.